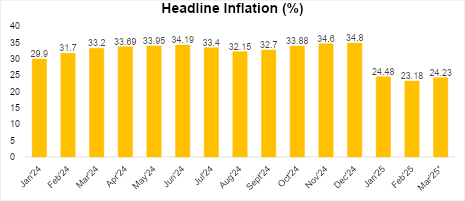

The National Bureau of Statistics (NBS) released its March 2025 Consumer Price Index (CPI) and inflation report yesterday, revealing an uptick in headline inflation to 24.23% year-on-year, up from 23.18% in February. This 1.05% increase was primarily driven by a sharp rise in core inflation to 24.43% in March from 23.01% the previous month.

A key contributor to the surge in core inflation is the hike in the cost of Premium Motor Spirit (PMS). Over the past year, the pump price of PMS has increased by approximately 31.4%, following the full removal of fuel subsidies by the Federal Government in the first half of 2024. This has significantly increased transportation and logistics costs, which are major components of core inflation. On a monthly basis, core inflation jumped to 3.73% in March, up from 2.52% in February.

More importantly, month-on-month headline inflation, which is a more current measure of price movement, surged to 3.90% in March, significantly higher than 2.04% in February. This further reinforces the fact that inflationary pressures are not only elevated but becoming more entrenched.

Food Inflation Decelerates Year-on-Year, but Monthly Pressures Re-emerge

Interestingly, year-on-year food inflation declined to 21.79% in March, from 23.51% in February. This moderation was driven by a stronger harvest compared to the previous year and weak consumer purchasing power, which has led to greater price sensitivity and resistance in retail markets. However, on a monthly basis, food prices edged higher as the seasonal benefits of the harvest began to wane, and festive demand during Ramadan and Easter exerted upward pressure. As a result, the food index rose to 2.18% month-on-month, compared to 1.67% in February.

Inflation is likely to sustain its upward trend in the coming months

Inflation is expected to remain elevated in the coming months, particularly as the economy enters the planting season in Q2, a period typically associated with reduced food supply and higher agricultural input costs. However, there may be some relief on the horizon as the Federal Government resumes crude oil sales to local refiners in Naira.

However, the broader inflation outlook remains fragile, with key risks stemming from FX volatility, global oil price movements, and uncertainty around global trade, especially in light of U.S. tariff developments.

With the resurgence in inflationary pressures, especially if the upward trend is sustained in the coming months, could prompt the MPC to tilt towards a more hawkish monetary policy stance.