The Nigerian bourse maintained a positive growth trajectory despite challenges with currency devaluation and volatility in the national economy in the first half of 2023, which is largely attributed to the new administration’s policies on subsidy removal and FX unification.

This report presents highlights of the performance of key sectors and companies in the first half of 2023, and key financial results for the period. The sectors examined are the Banking, Insurance, Oil & Gas, Consumer Goods, and Industrial sectors.

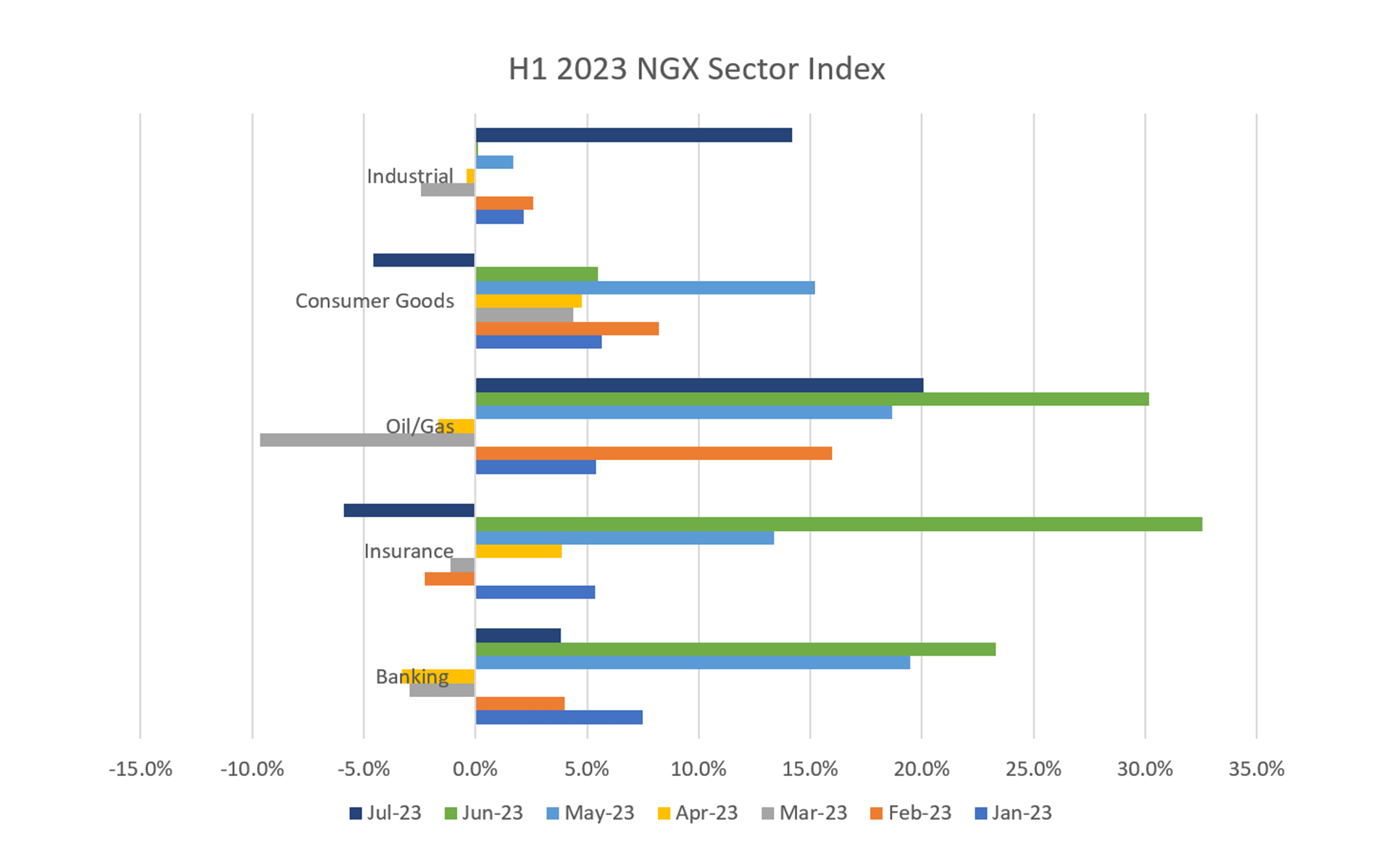

NGX Sectoral Performance

The Nigerian stock market saw positive growth across various sectors in H1 2023. The Banking and Oil & Gas sectors were the top performers, with impressive increases of 60.5% and 101.4%, respectively. The Insurance, Consumer Goods, and Industrial sectors also demonstrated significant growth, with increases of 49.5%, 45.0%, and 18.4%, respectively.

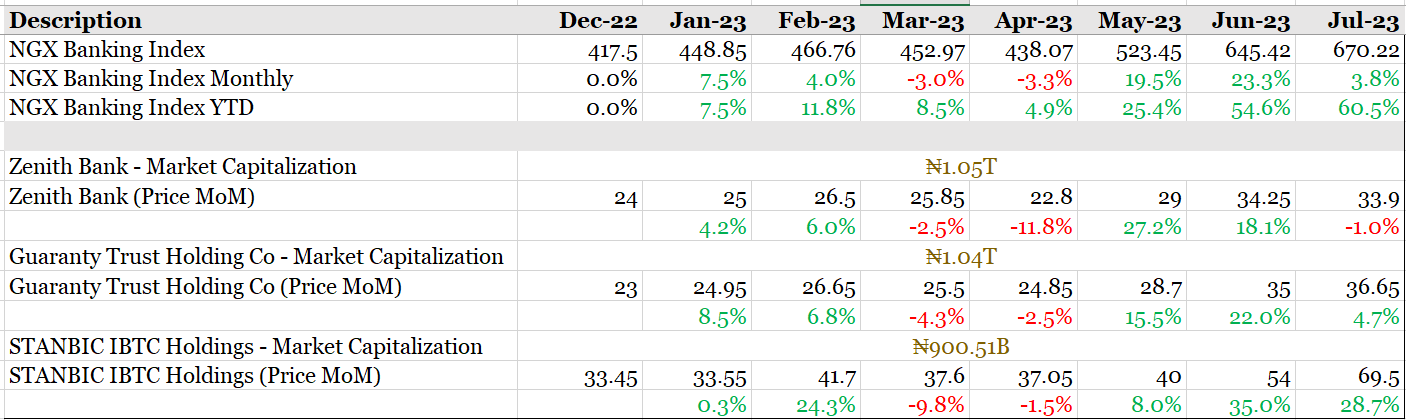

Banking Sector:

The NGX Banking Index showed a strong performance in the first half of 2023. The index started the year at 448.85 points and saw consistent growth each month, reaching 670.22 points by the end of July. This represents a remarkable 60.5% increase in the first seven months of the year. The sector saw significant gains in May and June, with monthly increases of 19.5% and 23.3%, respectively.

Zenith Bank

Zenith Bank experienced fluctuations in its stock price during the first half of the year. While it saw positive growth in January and February, it encountered a significant drop of 11.8% in March. However, it rebounded strongly in April, registering a substantial 27.2% increase. Overall, Zenith Bank’s stock price rose by 18.1% by the end of June.

GTCO

Guaranty Trust Holding Co also showed a similar pattern, experiencing a dip in March but recovering with a 15.5% gain in May and finishing the first half of the year with a 22.0% increase.

Stanbic IBTC Holdings

STANBIC IBTC Holdings demonstrated consistent growth, ending June with a remarkable 35.0% increase in its stock price.

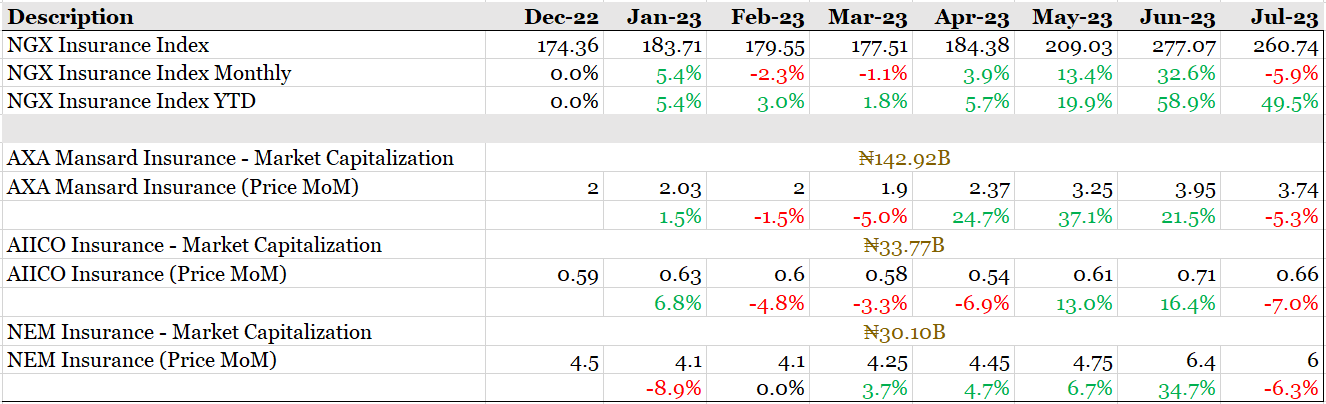

Insurance Sector:

The NGX Insurance Index showed steady growth during H1 2023, with a 49.5% increase by the end of June. The sector experienced monthly gains in all months except July, which saw a decline of -5.9%.

AXA Mansard Insurance had a volatile first half of the year, with its stock price fluctuating throughout the period. It registered significant gains in April and May (37.1% and 21.5%, respectively), but these were followed by a decline of -5.3% in June.

AIICO Insurance and NEM Insurance also experienced fluctuations in their stock prices during the first six months, with both companies ending June with negative returns of -7.0% and -6.3%, respectively.

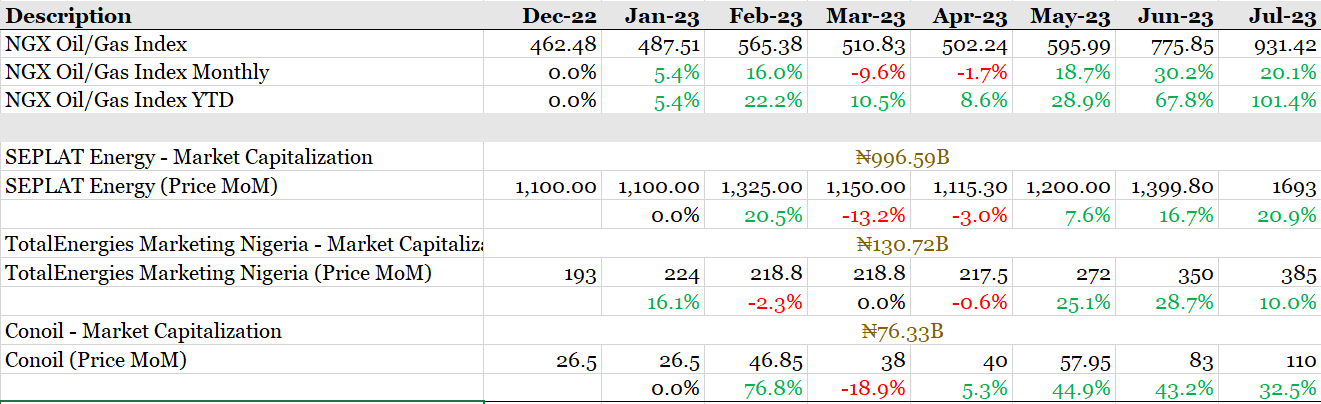

Oil/Gas Sector:

The NGX Oil/Gas Index demonstrated strong performance during the first half of 2023, with a remarkable 101.4% increase by the end of June. The sector experienced monthly gains in all months, except for March, which saw a slight decline of -9.6%.

Among the top oil and gas companies, SEPLAT Energy and TotalEnergies Marketing Nigeria had positive growth throughout H1 2023, with SEPLAT Energy ending June with a 20.9% increase and TotalEnergies Marketing Nigeria with a 10.0% increase. Conoil also performed well in the first half of the year, finishing June with an impressive 32.5% gain in its stock price.

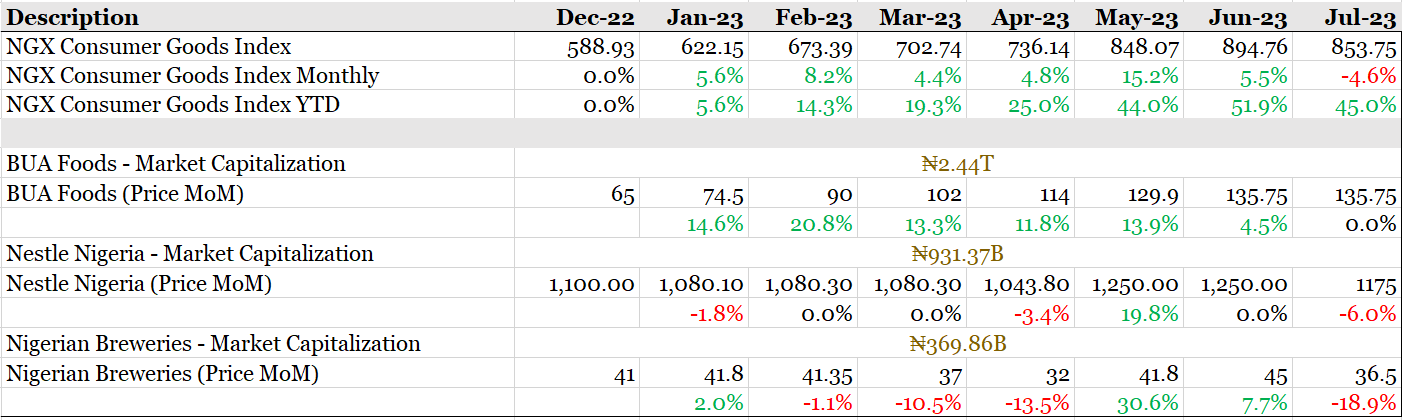

Consumer Goods:

The NGX Consumer Goods Index showed a solid performance during H1 2023, with a 45.0% increase by the end of June. The sector experienced monthly gains in all months except July, which saw a decline of -4.6%.

Among the top consumer goods companies, BUA Foods showed consistent growth during the first half of the year, with a 4.5% increase in June. Nestle Nigeria experienced mixed results, with a 19.8% gain in May but a -6.0% decline in June. Nigerian Breweries saw significant growth in April (30.6%) but ended June with a substantial decline of -18.9%.

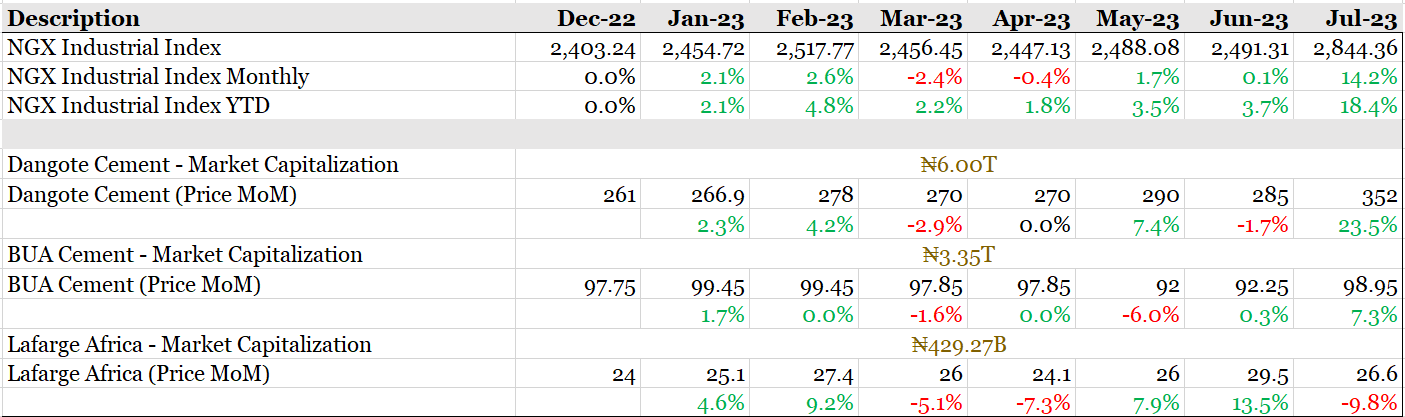

Industrial Sector:

The NGX Industrial Index demonstrated steady growth during H1 2023, with an 18.4% increase by the end of June. The sector experienced monthly gains in all months except February, which saw a slight decline of -2.4%.

Among the top industrial companies, Dangote Cement showed strong performance in H1 2023, ending June with a remarkable 23.5% increase in its stock price. BUA Cement also performed well, finishing June with a 7.3% gain. Lafarge Africa had a volatile first half of the year, with significant fluctuations in its stock price, ending June with a -9.8% decline.

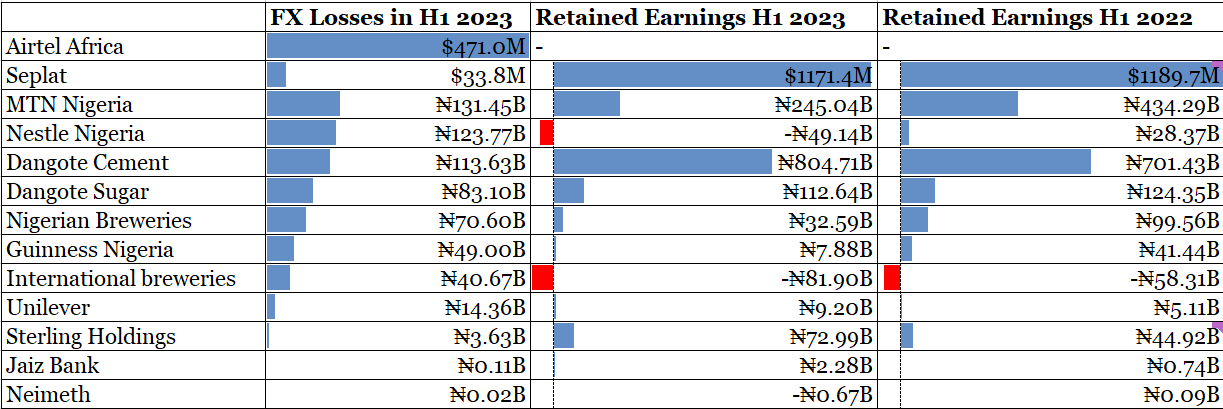

Financial Highlights of Selected Companies in H1 2023

Some companies have announced their financial results for the first half of the year ended June 30, 2023. The results shows good earnings amidst significant FX losses.

Here are some key financial highlights for these companies:

1. Airtel Africa

– Market Capitalization:

– FX Loss in H1 2023: $471.0M

– Retained Earnings H1 2023: Not available (N/A)

– Retained Earnings H1 2022: N/A

2. Seplat

– FX Loss in H1 2023: $33.8M

– Retained Earnings H1 2023: $1,171.4M

– Retained Earnings H1 2022: $1,189.7M

– Seplat demonstrated strong financial performance with significant retained earnings, though it faced a moderate foreign exchange loss in H1 2023.

3. MTN Nigeria

– FX Loss in H1 2023: ₦131.45B

– Retained Earnings H1 2023: ₦245.04B

– Retained Earnings H1 2022: ₦434.29B

– MTN Nigeria’s retained earnings declined due to a substantial foreign exchange loss incurred in H1 2023.

4. Nestle Nigeria

– FX Loss in H1 2023: ₦123.77B

– Retained Earnings H1 2023: -₦49.14B (negative value indicates a deficit)

– Retained Earnings H1 2022: ₦28.37B

– Nestle Nigeria faced a significant foreign exchange loss and a decline in retained earnings in H1 2023.

5. Dangote Cement

– FX Loss in H1 2023: ₦113.63B

– Retained Earnings H1 2023: ₦804.71B

– Retained Earnings H1 2022: ₦701.43B

– Dangote Cement experienced a substantial foreign exchange loss but maintained strong retained earnings in H1 2023.

6. Dangote Sugar

– FX Loss in H1 2023: ₦83.10B

– Retained Earnings H1 2023: ₦112.64B

– Retained Earnings H1 2022: ₦124.35B

– Dangote Sugar faced a significant foreign exchange loss but managed to retain considerable earnings in H1 2023.

7. Nigerian Breweries

– FX Loss in H1 2023: ₦70.60B

– Retained Earnings H1 2023: ₦32.59B

– Retained Earnings H1 2022: ₦99.56B

– Nigerian Breweries reported a substantial foreign exchange loss and a decline in retained earnings in H1 2023.

8. Guinness Nigeria

– FX Loss in H1 2023: ₦49.00B

– Retained Earnings H1 2023: ₦7.88B

– Retained Earnings H1 2022: ₦41.44B

– Guinness Nigeria experienced a significant foreign exchange loss and a decline in retained earnings in H1 2023.

9. International Breweries

– FX Loss in H1 2023: ₦40.67B

– Retained Earnings H1 2023: -₦81.90B (negative value indicates a deficit)

– Retained Earnings H1 2022: -₦58.31B

– International Breweries faced a substantial foreign exchange loss and continued to carry a deficit in retained earnings in H1 2023.

10. Unilever

– FX Loss in H1 2023: ₦14.36B

– Retained Earnings H1 2023: ₦9.20B

– Retained Earnings H1 2022: ₦5.11B

– Unilever showed an increase in retained earnings in H1 2023 despite a foreign exchange loss.

11. Sterling Holdings

– FX Loss in H1 2023: ₦3.63B

– Retained Earnings H1 2023: ₦72.99B

– Retained Earnings H1 2022: ₦44.92B

– Sterling Holdings experienced a foreign exchange loss but maintained healthy retained earnings in H1 2023.

12. Jaiz Bank

– FX Loss in H1 2023: ₦0.11B

– Retained Earnings H1 2023: ₦2.28B

– Retained Earnings H1 2022: ₦0.74B

– Jaiz Bank’s retained earnings increased in H1 2023 despite a minor foreign exchange loss.

13. Neimeth

– FX Loss in H1 2023: ₦0.02B

– Retained Earnings H1 2023: -₦0.67B (negative value indicates a deficit)

– Retained Earnings H1 2022: ₦0.09B

– Neimeth reported a minor foreign exchange loss and continued to carry a deficit in retained earnings in H1 2023.