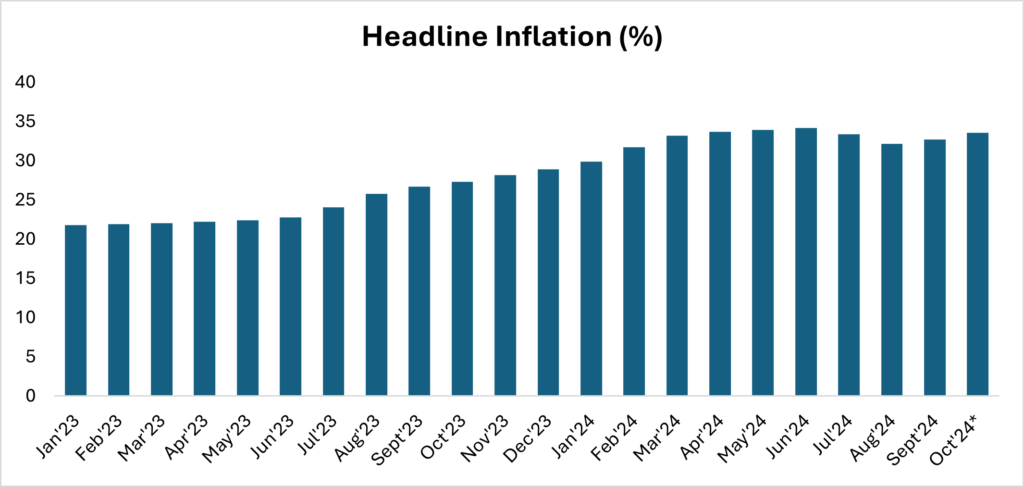

Inflation has become a key economic indicator that is closely monitored by individuals, businesses, investors, and policymakers, given its substantial impact on consumer purchasing power, the cost of doing business, and the value of investments. In 2024, Nigeria’s headline inflation has risen in seven out of the nine months so far, with brief declines in July and August, mainly due to base effects, the harvest season, and the 150-day suspension of tariffs on essential staples. However, inflation began to climb again in September and is expected to increase further in October when the National Bureau of Statistics publishes its data on November 15. Our model forecasts a 0.88% rise in headline inflation, bringing it to 33.58% from 32.7% in September. This uptick is mainly due to base effects and the pass-through impact of the exchange rate. On the other hand, month-on-month inflation is expected to moderate slightly, declining to 2.41% from 2.52% in September, as the effects of the recent multiple fuel price hikes begin to diminish.

All inflation sub-indices to move in tandem with headline inflation

According to our model and macroeconomic analysis, all inflation sub-indices are expected to follow a similar trend as headline inflation. This highlights the influence of the base effect on the annual inflation figures, as well as the fading impact of recent PMS price hikes on the monthly inflation index.

On an annual basis, food inflation is projected to rise by 0.47%, reaching 38.24%, while on a monthly basis, it is expected to decrease to 2.26%, down from 2.64% in September. The projected annual increase in food inflation is partly driven by the base effect, while the monthly decline reflects the ongoing harvest season and the 150-day suspension of tariffs on key staple goods.

Similarly, the annual core inflation sub-index, which excludes food and energy prices, is forecast to increase to 28.13% from 27.43%, while the monthly core inflation is projected to moderate, declining to 1.95% from 2.1% in September.

Inflation and likely policy response

The Monetary Policy Committee (MPC) is set to hold its final meeting of 2024 later this month. Based on our inflation projections, it is likely that the committee will opt for a 25-basis point increase in the MPR, with a stronger emphasis on fulfilling their core mandate of maintaining price stability.